To say that Covid-19 has – and is – dramatically impacting art businesses and collectors all around the world, would be an understatement. In a very short space of time, every business and individual working in the art world has had to adapt to a different – predominantly digital – way of operating.

Four leading authorities from different areas of the art market: Melanie Gerlis, Art Market Columnist, Financial Times; Oliver Shuttleworth, Fine Art Consultant and Broker, Oliver Shuttleworth Fine Art; Arthur Byng Nelson, Solicitor and Legal Director, Harold Benjamin; James Mayor, Mayor Gallery answer some of the questions that have been at the forefront of our minds…

Founded in 1966, leading conservation company Plowden & Smith has played a key role in the international art world for over fifty years.

Clients include blue chip galleries, international auction houses, specialist fine art insurers, leading art lawyers, top independent art consultants and curators, art logistics companies, as well as many private collectors, some of whom buy for pleasure others predominantly for investment.

With so many different art businesses and art market professionals as clients, it has always been important for us to have a good understanding of the issues affecting the art world.

To say that Covid-19 has – and is – dramatically impacting art businesses and collectors all around the world, would be an understatement. In a very short space of time, every business and individual working in the art world has had to adapt to a different – predominantly digital – way of operating.

Over the past weeks, we have been inspired by the way so many art businesses have used technology in innovative and creative ways to engage existing audiences, and also to reach new ones. Podcasts, webinars, virtual viewing rooms that allow you to see what a work of art looks like in your own living room…it is indisputable that the way individuals connect to ‘do’ art (whether that be to discuss, buy, create, learn about) has changed, with many commentators feeling that these initiatives are making art more accessible.

But has the art market changed in a more fundamental way? With lockdown poised to end, but social distancing here to stay, what next?

Four leading authorities from different areas of the art market, Melanie Gerlis, Art Market Columnist, Financial Times; Oliver Shuttleworth, Fine Art Consultant and Broker, Oliver Shuttleworth Fine Art; Arthur Byng Nelson, Solicitor and Legal Director, Harold Benjamin; and James Mayor, Mayor Gallery answer some of the questions that have been at the forefront of our minds.

Finally, we asked Louise Hamlin, Director of the Art Business Conference to provide a general summing up of the outlook for the art world, based on these interviews.

We started off by asking all our experts, How do you anticipate the art market evolving over the next 18 months?

Melanie Gerlis:

We are really in the most uncertain part of this crisis. Auction houses hope to make up for some of their losses before the end of the year and galleries are tentatively opening in Asia and Europe. But no-one knows how secure the falling infection rates will be. What is certain is that online sales will be dramatically up for most art businesses, and their costs will be reduced, but these trends won’t make up the slack from no art fairs, live auctions and travel in this (previously) relentlessly global market. Galleries around the world are predicting a 70% fall in sales in the near term, and some won’t be able to survive. So, from where we are sitting now, I predict a fall of 50% in the overall market value for 2020, with a little made up in 2021.

Arthur Byng Nelson:

The volume of transactions has sharply decreased, that is clear. I am seeing art owners reviewing timetables for proposed sales and executors and trustees seeking advice on their options. My hunch is that post Covid 19 we will see a rise in sales of works of art by historic houses. Also I expect the phenomenon of “deaccessioning” to come to greater consciousness as museums consider how to meet significant budget shortfalls.

What has struck me during this period is the very positive and brilliant way that museums and commercial galleries have provided fascinating material on the works that they hold. Those providing such context by podcast, video, email will come out of this crisis with new and broader audiences.

James Mayor:

It’s a tough one, one needs a crystal ball. Personally, I think the idea of art fairs this year, is like living in cloud cuckoo land. I think the first important fair will be the ADAA fair in New York at the end of February or TEFAF in Maastricht in March. Art Basel Hong Kong is unlikely to take place due to the political situation. I think the first of the Art Basel fairs will take place in June next year.

Oliver Shuttleworth:

There has been (and will continue to be) significant pressure on the art market to move online via online auctions and online gallery viewing rooms. Whether that equates to sales above a necessarily high threshold remains to be seen. However, there have been a number of big prices including 1.58m USD paid for a Giorgio Morandi painting in the Sotheby’s online sale on 18th May. What concerns me is the longevity of this process – seeing works of art physically is central to the buying process as one can never truly appreciate a painting based on a photograph. I envisage mistakes being made and paintings being returned, especially when significant million-dollar prices are being paid.

Arthur, as a solicitor and Legal Director at Harold Benjamin, you are often counselling clients on matters that relate to art, picking up on Oliver’s point about a potential consequence of more paintings being bought sight unseen will be more paintings being returned, is there a legal angle to this that buyers and galleries need to be aware?

Returning to the financial theme, there is little doubt that the UK and much of the world is heading into a recession. However, in the past the art market has proved itself to be resilient to recessions.

Oliver as an art consultant and broker, you are advising collectors about what to buy and sell, and when of course to buy and sell. What would be the best sort of work, if any, to sell during a recession?

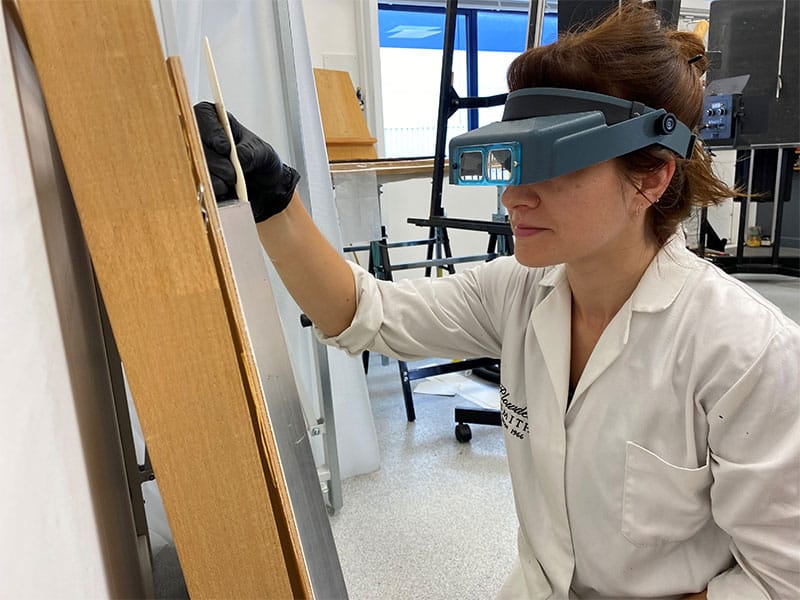

Plowden & Smith’s Senior Painting Conservator condition checking an early work by Peter Paul Rubens, “Lot and His Daughters”. Described by Christie’s as exceptional, it was sold in 2016 by the auction house for £44,882,500, at the time the highest price ever achieved for an Old Master painting at Christie’s. Looking ahead to an anticipated post Covid-19 recession, great works can command exceptional prices, even during a recession. But will they appear on the market?

James, The Mayor Gallery was of the first London Galleries to open its doors (in 1925). What do you think the future holds for galleries?

James Mayor:

It’s a sad thing, old fashioned galleries, those with less than a dozen employees will struggle as will the younger, smaller galleries. People don’t tend to visit them. The mega galleries tend to get all the press and the excitement of collecting is taken away, people are buying a brand. People used to buy art because they like it, but now it seems to be an asset class. I believe there should be two criteria to buying art, that you like it and that you can afford it. Most people that buy art are self-made, so I’m surprised that they buy at the top end of the market, it’s a complete reversal of their business model.

The larger galleries don’t build relationships like the smaller galleries, the sales team are all about their commission. Smaller galleries build loyal collectors by building relationships.

Oliver, you started your career at Sotheby’s auction house and were a Director of the Impressionist & Modern Art department for a number of years. What do you think the future holds for auction houses?

I think the future is fine so long as works of art can be viewed physically. Cataloguers and some specialists will need to work on site with the works of art, but the rainmakers and top management need not necessarily work from an office space. I do think the days of vast offices in Manhattan, Rue de Faubourg, Mayfair and St. James’s are numbered.

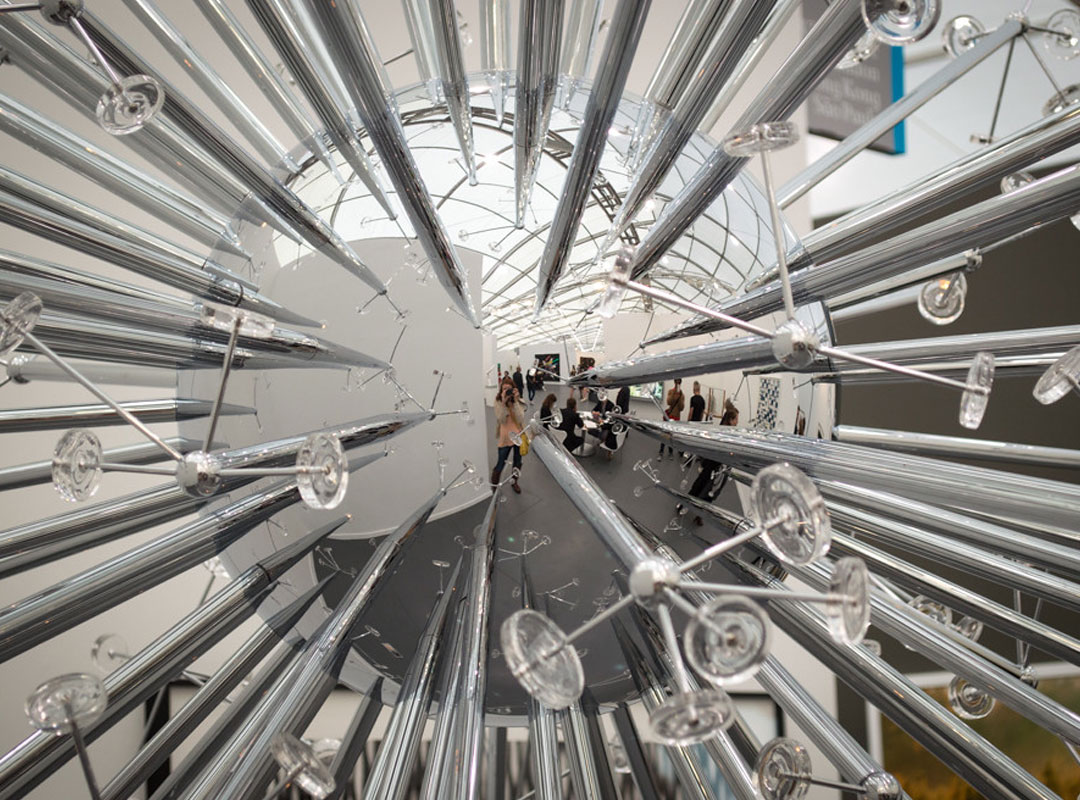

Sotheby’s June 2019 Impressionist and Modern Art Evening Sale, London. But is the sight of a packed saleroom a thing of the past?

That’s very interesting and does bring us on to a point about the reliance on galleries and auction houses on smart bricks on mortar premises in the ‘right’ location. Rents in these sorts of exclusive neighbourhoods tend to be astronomically high, so for many galleries we can see silver linings in needing less space, or potentially even no space.

Furthermore, we imagine the benefits of no longer having to invest money in a physical space will be felt most by many smaller galleries.

Is there a potential for a shift online to ‘level the playing field’ amongst small and large galleries and dealers, or will it merely entrench existing hierarchies?

There will be an element of some galleries managing to operate more virtually and therefore more cheaply and the more collaborative spirit will prove helpful for survival. Most of the smaller galleries were already on this trajectory, from necessity, and could find themselves more nimble than most to operate efficiently in the post Covid world.

We could also see the brand name art fairs relax their rules about exhibitors needing to have a bricks and mortar space, which would help (and only seems right now that the fairs are virtual too!)

Generally though, I’m afraid that in any sort of recession, there’s a survival of the fittest and most of the healthiest galleries will be the better known, established businesses, who are able to get established artist’s work to established collectors. The taste for risk and experimentation will suffer for a while. In terms of what sales at the recent and much discussed virtual Frieze NY tells us about this… it’s hard to know for sure, but online fairs are getting better in terms of the works people are showing virtually and the ability to navigate around them. Certainly, sales were reported by galleries and the majority seemed to be under the $30,000 level.

Oliver Shuttleworth:

As the great New York Times critic, Jerry Salz, intimated: an online gallery is only a fancy name for a website. Much has been made of the online gallery experience but frankly the need to view works physically will remain vital. Major galleries will have the funds to send paintings to collectors on approval far more readily than a smaller gallery. Larger galleries will still be able to advertise more thoroughly and attract the best artists and works of art. The major players had a huge advantage going into this situation and the entrenchment of the top galleries will continue, for better or for worse.

What do you think about the future of online transactions?

Personally, it amazes me that people will spend 100s of thousands or millions on unseen works. Although reproduction of certain artworks can work online, you really need to see the surface of the artwork as they can look different on different devices. You can’t see a true representation of the colour. In the old days, we used transparencies which we compared to colour charts.

Picking up on Melanie’s point earlier about the taste for risk suffering in an uncertain financial climate, do you agree? How might covid-19 influence collectors’ buying choices?

There is talk of the market reverting to more established, blue-riband, artists with a deep buying pool and, though vague, I think that is a fair assumption. I feel there may be problems for bleeding edge contemporary artists and those derivative late 19th century artists that are already struggling. Whatever happens over the next few years, great art will always command an outstanding premium over the merely good or mediocre.

I‘d love to see a stable market and a return to the times where people find something they love and start collecting it. To put together an interesting collection takes time, energy and love.

I believe that this period of lockdown has increased appetites for context, for academic content, in the presentation of art. If I am right, in the commercial world, the result might be a greater reluctance by buyers to fork out huge prices for some contemporary works and an increased interest in more discrete sectors of the market where a potential buyer can be confident that he or she is purchasing something that has its place in art history.

Art fairs have dominated many Covid-19 conversations. This is hardly surprising considering that in 2019 there were over 300 art fairs taking place on an almost daily basis around the world, and most galleries made almost 50% of their annual sales at art fairs.

As Art Market columnist for the Financial Times and former Art Market editor of The Art Newspaper (currently, Editor at Large) Melanie, you have been reporting on art fairs globally since 2006.

Not so long ago it looked like the trend for more art fairs in every corner of the globe was only going to grow, however it’s also fair to say that over the past few years we have sensed some frustration from galleries and other art professionals obliged to fly half way round the world to exhibit at, or attend at huge expense and disruption, yet another art fair.

In view of the pressures placed on all industries, not just the art world, to become more sustainable, do you think Covid-19 is only accelerating an inevitably decline – possible death? – of the Art Fair?

It has certainly accelerated the pressures around art fairs anyway – concerns about the costs of doing these (financial and ecological) were already gaining ground. At the same time, the virtual offerings do the job okay, but are not particularly inspiring, which is problematic for emerging artists and for discovery by potentially new collectors.

What about you, James?

I think the major fairs will take place, ADAA, Basel, TEFAF, Frieze and FIAC but the lower tier fairs will disappear completely, although the smaller regional ones will keep going.

Over 300 art fairs took place all over the world in 2019. Post Covid-19, how many of them will reopen?

Looking ahead, Oliver do you think has Covid-19 permanently changed the way the art market operates? If so, in what ways?

Oliver Shuttleworth:

So much depends on finding a vaccine, as the way that the market operated prior to Covid was what the market wanted: packed auction rooms and Art Fair openings were exciting and enjoyable. If there is no way to return to those ways of operating, then obviously the art world will change. Gallery viewings with appointments will be mandatory; Auctions will take place online with viewings prior to sale by appointment; increased advisor activity to account for a less ‘enjoyable’ buying process and significantly fewer parties, lunches and events.

However, with collectors spending more time at home perhaps the works of art they live with will be more important to them – perhaps the art market will have a new buying public who are less content with blank or poster-filled walls.

Louise Hamlin’s Review | Post Covid-19, What Next for the Art Market?

We invited Louise Hamlin, Founder and Director of Art Market Minds and Founder and Director of the Art Business Conference, to comment on some of the points raised by Melanie, Oliver, James and Arthur during this interview and to provide a final summing up…

Louise Hamlin:

For quite some years now, art market commentators alluded to a change or market correction, but I don’t think anyone could have anticipated the depth of change that took effect in such a short space of time, and one that has so dramatically impacted the global art market in the way that Covid-19 has.

As Melanie writes, we are now entering one of the most uncertain parts of the crisis as businesses start to reopen and find themselves having to make operational changes and navigate new Health & Safety procedures. There will certainly be tough decision making in the months ahead for businesses in terms of liquidity, workforce and operating costs.

I am sure that 2020 art business plans will have been reviewed, rewritten if not ripped up altogether! As to writing a business plan for the next 18 months I fear for now, this is not even possible and that a day by day, month by month approach must be adopted. During this critical time, the ability for art businesses to be agile and pivot to changing business conditions is essential.

Despite all of the challenges and uncertainty that Covid-19 has brought to the art world, I think there are some positives to consider.

Less travel commitments, whether the daily commute or business travel, might allow for more time and contemplation. As Arthur cites, there is definitely an appetite for a more considered approach to reviewing art and this is a good opportunity to engage collectors with the great knowledge base and expertise from both the academic and commercial art worlds.

For those who already have a collection, hopefully this additional time spent at home will foster new levels of engagement and curiosity, with time to update those all-important collections management records or provenance research. And as Oliver points out, those at home with blank walls might be motivated to start a new collection after 12 weeks of lockdown!

As Melanie asserts, there will be inevitable market corrections, although I am not sure we will see a huge change at the top end of the market, where private jets, cars and yachts will enable ultra high net worth individuals to continue to move and socially distance and they will be still be able to view art privately. And at the very top end, art will be moved and sent on approval.

I completely agree with Oliver’s perspective that individual prices can be very strong during recessions or crises, especially if supply reduces. Therefore, it’s doubly important that collectors have the right advisors to guide them on their buying and selling decisions. And, during these uncertain times, with other industries affected such as hospitality and property, this could drive new speculators and investors to the art market.

I think we are all now more conscious of our global footprint and so I hope that the positive momentum on sustainability isn’t lost and a better future balance on global art travel can be found. I think the focus will shift, as James observes, to a more local, regional art community.

One of my aims in creating the Art Business Conference was to help foster a sense of community and bring together different corners of the art market who might not interact with one another on a regular basis.

In order to navigate through this crisis, galleries, auctions, museums, art advisors and all those who provide services to our community will need to find more efficient and effective ways to work together. Therefore, for me another positive has been the recent collaborations and partnerships that have formed across the different sectors.

Following on from this, digital technology is now front and centre of the artworld’s attention as the enabler of collaborations, partnerships, operating efficiencies and ultimately connecting and engaging with collectors. And although we might not appreciate the increase in screen time, I think we are thankful for the technologies available to us in 2020.Think how many digital tools are at our disposal today to help our businesses run more efficiently and then imagine if this pandemic had occurred 10 years ago?

Over the past few years, the Art Business Conference has worked to help promote some of the organisations within the Art Innovators Alliance, as well as others outside this group, many of whom have worked tirelessly to create digital tools that have been much needed and finally adopted by the art market these past three months, including online viewing rooms, digital condition reporting and online logistics.

It has been positive to see the results of their hard work being used more widely across the industry, and also seeing a greater engagement because of these new digital media forms, including Virtual Reality and Augmented Reality.

I hope we will see the continuation of digital innovation and that the momentum isn’t lost, once the physical viewing of artworks reconvenes. I think the two must run in parallel to negotiate the potential bumps, twists and turns in the road ahead over the coming 18 months and beyond.

More from the Blog

Post Covid-19 – What Next For Auctions?

Condition Reporting Stories from our Specialists…